|

|

|

|

You are viewing: Main Page

|

|

September 16th, 2023 at 03:54 am

I realized this month, I haven't been using my budget. Money in, money out, autopay, etc.

There's a reason. In April, I was diagnosed with Breast Cancer. And all things came to a halt. Thank gosh for auto pay.

I cashrolled all my medical bills since March, so even had to pay cash for 2 CT scans because my I insurance denied them. 10k so far.

I have two chemos left, then surgery and radiation. Some of the radiation may spill into 2024... so it will cost me $50 a day for a few weeks.

Good news: My latest mammo and ultrasound show no evidence of disease! The chemo worked!!

So, I rebuilt my budget for Q4. Student loans start up next month. My bill went fom $614 to $976.  No idea why. So, I won't be able to pay as much extra to the mortgage now. But I'll figure it all out. Just glad to be refocused! And so thankfully I had that extra savings account I had been socking money into. I would have hated to put cancer treatment on a credit card! No idea why. So, I won't be able to pay as much extra to the mortgage now. But I'll figure it all out. Just glad to be refocused! And so thankfully I had that extra savings account I had been socking money into. I would have hated to put cancer treatment on a credit card!

Posted in

Uncategorized

|

4 Comments »

January 2nd, 2023 at 08:40 pm

Or Zelle transfers, cash handing out, debit card loaning... whatever you want to call it - it's done. I lent my son $2000 for rent on Dec. 31 - and I said, I'm done. No free money in 2023. I love my kiddos DEARLY. But why do I need to pick up the slack when they aren't giving 100% first? My DIL could be working more, taking on more clients... but she doesn't. It never really bothered me until today when I realized that I KEEP ENABLING THESE KIDDOS! I have to stop.

We did some good things last year. Spent some good money. Took care of our family... but I have to get this money to start working for us! Lending it out helps no one. So, the answer is NO. Sorry, it's tied up. #sorrynotsorry

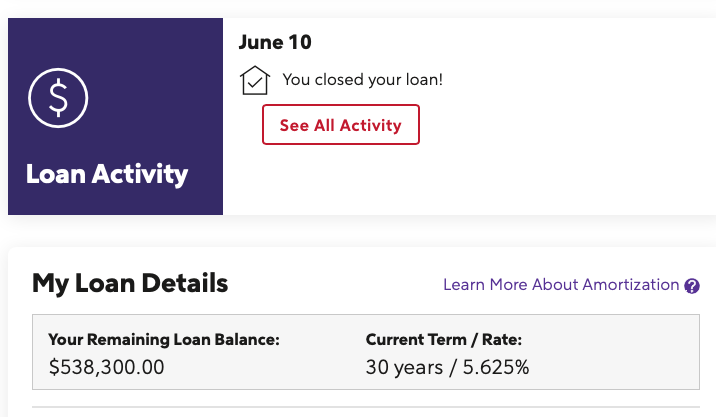

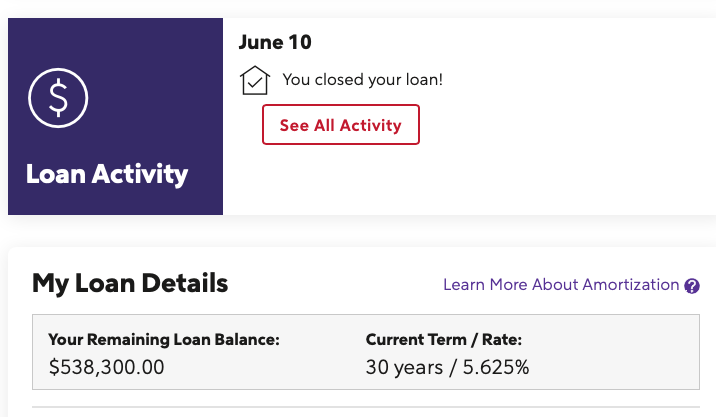

I have tax/IRS stuff to work on this month. I need to find a new accountant, and also maybe a financial planner. We did well saving money this year and we also paid down a FULL year off the end of my mortgage and saved 31K in interest already. I just updated my sidebar... Loan was 538K on July 1, and on Jan 1, we owe 527K. We are just going to keep at it. I don't want the payment anymore.

I did my budget for first half of 2023, and we were able to cut in some areas... for example: We've been with Verizon for 20 years?! My husband had a chance to Beta with Boost Mobile through his work and is paying $15 a month for what he was paying $100 for before. He can't move the family lines over yet, but we will eventually. I need to get out of this brand loyality mindset. It screws me every time.

I keep hearing about "when this is all over, when things go back to normal..." Why would they ever? If they have us paying $9 for a dozen eggs, why would they EVER lower it back down to $0.99?

In other news, I have been with my new bank for almost a year... and was just offered the Chief of Staff position for the Mobile App organization. WHICH IS WAY COOL. Except, HR considered it a lateral move, so there was zero increase in pay. And that makes me mad. It will be soooo much more work. Especially my new boss... no kids, no family, works 24/7... He is super fair, and hated that he couldn't give me $$, so he let me know he would make up for it at bonus time NEXT Feb. (my bonus and merit for this Feb. is already figured out). I believe he will, but that's a long time. So, that motivated me to say no to the kids, and also cut down on spending where I can. A reverse pay increase?!

Okay, that's it for now... I need to head to the grocery store. Using gift cards I got for Christmas.

Posted in

Budgeting,

Debt,

Saving Money

|

4 Comments »

November 11th, 2022 at 08:43 pm

Hi! I had a bit of trouble with my Mac and haven't checked in - in a while. But I am here now and look forward to catching up on all of YOUR posts.

For us... well, my second grand daughter was born on Sept. 28 and she is ADORABLE.

(PICTURES TO COME, SA isn't letting me load right now)

We found out on Halloween that our first grand daughter is going to be a BIG SISTER! So that's super exciting.

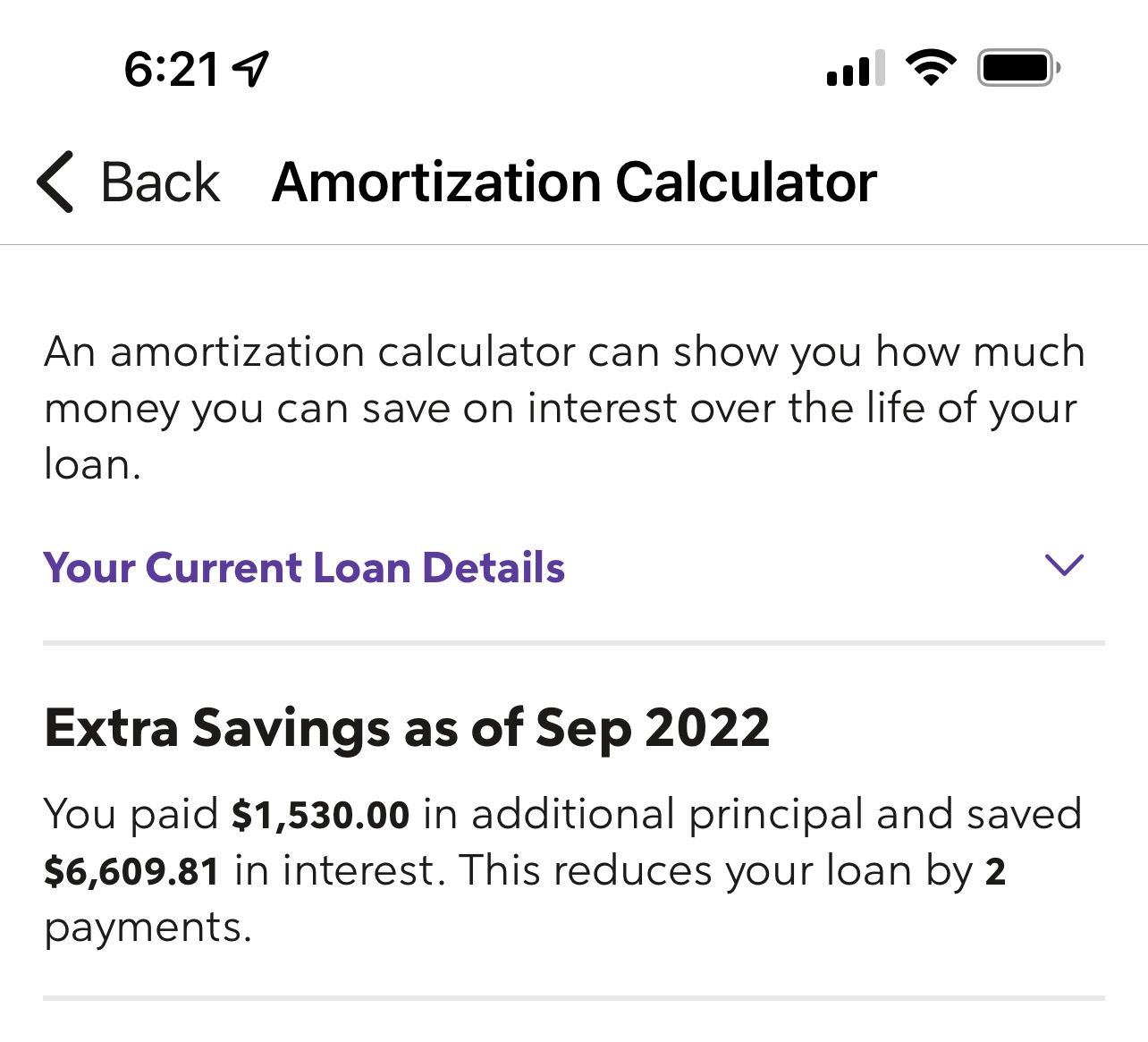

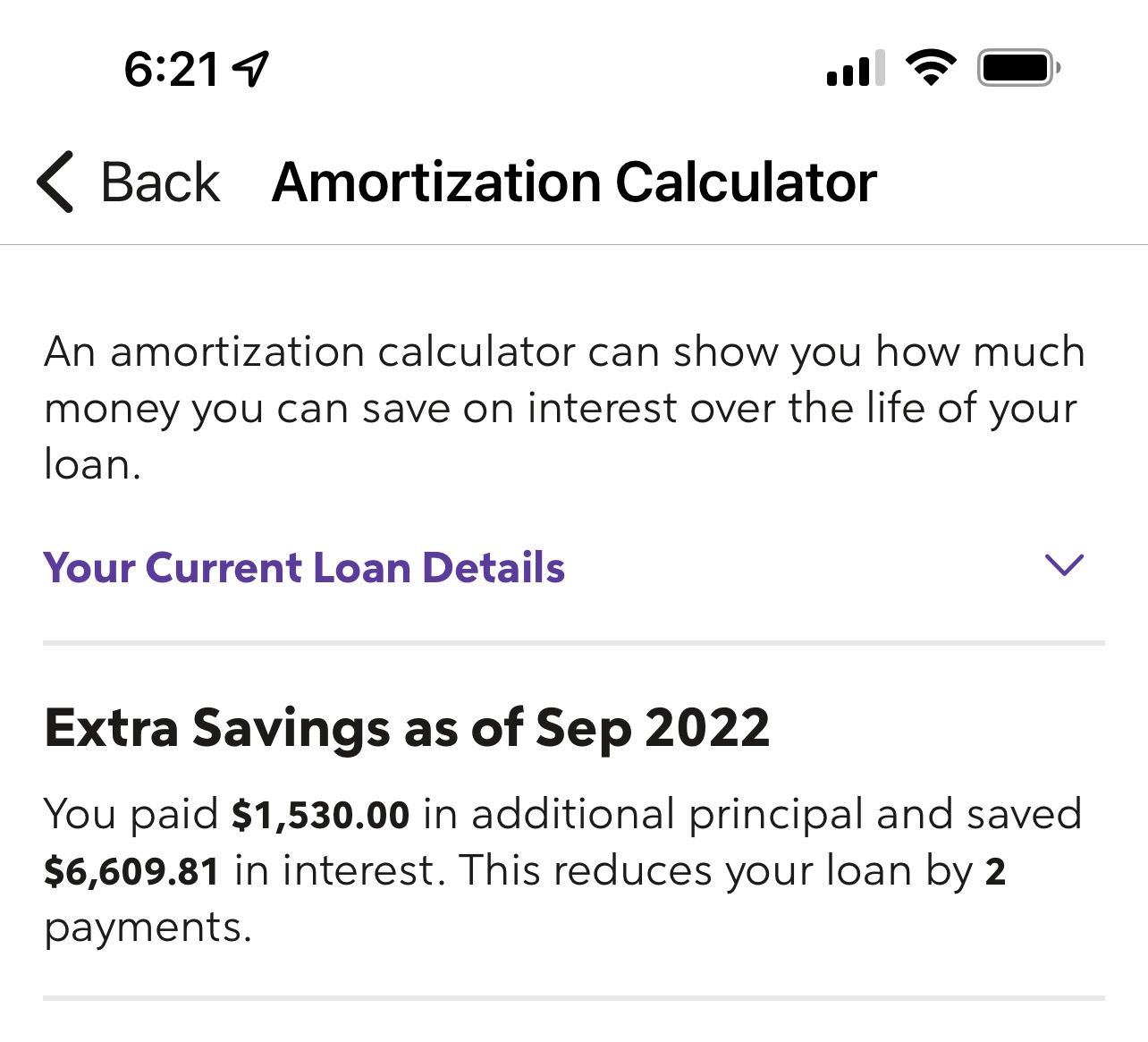

I've let auto-pay handle life in Sept. and Oct., but that isn't helping us stay focused. So, I logged on this morning and built out our Nov. and Dec. budgets. I've still paid extra on my mortgage, and even created a little cheat sheet for a visual motivator. We've made 4 regular monthly payments, and also paid $1500 extra to principle a month, knocking off 7 payments so far at the end. So much white space on the page, but I am looking forward to the gap growing smaller. Also hoping to refinance next summer, fingers crossed. Mortgage is down to $531K from $538K.

Spending is still way too much. But, I've got a plan for the new year.  More to come on that. The good thing is SAVINGS is going so very well. More to come on that. The good thing is SAVINGS is going so very well.

Posted in

Uncategorized

|

2 Comments »

September 2nd, 2022 at 03:04 pm

I just typed out a VERY long post, and it’s NO WHERE TO BE FOUND. Oh, Savings Advice… do better.

Let’s try this again.

With August in the rearview mirror, we are feeling a bit beaten up. It was a very spendy month, but we knew that going in.

Baby Shower… when it’s all said and done, and it is - I think we spent about $4500. Thankful my son-in-law’s family contributed $700 and my parents $400. We had a great time, and my daughter and her husband felt LOVED, so that’s all that matters.

We paid our first mortgage payment ($3098) in July for August, and then I paid an extra $1500 towards principle. That alone saved us two payments and $6600 in interest. Not bad!

As far as a savings update goes, we put $800 in our savings account last month and $1000 in our CMA.

I ended up paying $3125 towards our credit card today… the balance is made up of a $1700 medical bill, the baby shower and then $500 for an old collections account of my daughter’s. During COVID, the power company let them run up their bill without shutting it off for non-payment. She thought it was FREE! Well, last week, I got a letter from the power company saying they added her balance to my PRISTINE account because she was benefiting off of my power. I was LIVID. With her and the company. Called them and spoke to 3 people before I got them to realize they were in the wrong. The rule is, if *I* benefitted from power at both places, then they could transfer the amount owed. Not if *she* benefitted. So, they removed it. I then gave her my credit card and told her to pay the darn balance. I realize no real lesson learned here, other than her having to hear me rant about her irresponsibility. She will pay me back this month. The rest of the card's balance will be paid this month since it's a three-paycheck month for me. So, we should start out Oct. fairly clean.

September is baby month! Because my daughter hasn’t been at her job for a year yet, she won’t get paid 4 months of maternity leave. She can take time off, but it’s all unpaid. She failed to sign up for short term disability (the baby was a happy little surprise!). They crunched the numbers and think she can take off 12 weeks. Of course, she lives with us and her expenses are minimal. So, things will be fine. She did manage to pay off her car, her cards and cash flowed all her pregnancy related medical bills this whole time, so I am thankful for that. Her and her husband are welcome to stay through 2023, but then they are going to look for a place in between both families.

Right around the corner, our property taxes and homeowners insurance is due. We won’t have quite enough saved in our Escrow Home account by then, so I will likely have to borrow from other accounts to cover the gap. But for spring, we should be good!

Okay - see? Long update. Typed out twice. This time in a Word doc, then pasted in to SA. Learned my lesson!

Posted in

Uncategorized

|

6 Comments »

August 12th, 2022 at 07:21 pm

Husband was paid today, and I moved $500 to our joint CMA for down the road investment purposes. I also paid $140 principle only to my mortgage. I contemplated putting that money in our Snowball account, but figured it was more fun to pay each week. There are some months it will be the whole $1500 out of one check, this month, I had to split the $1500 across 4 checks, so last week, I paid $100, today $140 and then I will pay the remaining out of the last two checks of Sept. I think this helps me interest wise, too.

I had $200 earmarked for extra payment to my student loan, which is still in limbo. So, it's in my Snowball account. And finally, I have $400 for groceries this week.

I think we are planning to do some DIY house projects this weekend, so I expect some Home Depot spending. Nothing crazy, just adding paneling/board and batten on a few walls. Probably less than $200 total for this weekend.

Our meal planning is not happening, so I need to get serious. It’s been a crazy month, and we are trying to get past the baby shower - and hopefully things will calm down a bit. But then right around the corner is grand baby #2, Halloween, Thanksgiving and Christmas. So, maybe a slow, quiet inexpensive September, please? Haha. One can wish.

Posted in

Uncategorized

|

4 Comments »

August 5th, 2022 at 08:10 pm

I didn't even realize it was Friday or I got paid until I recieved a text message alert from my bank regarding the direct deposit.

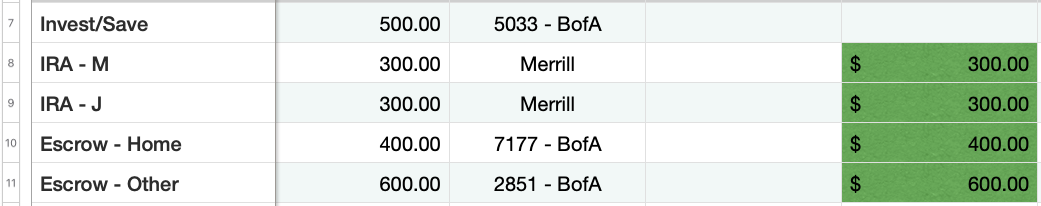

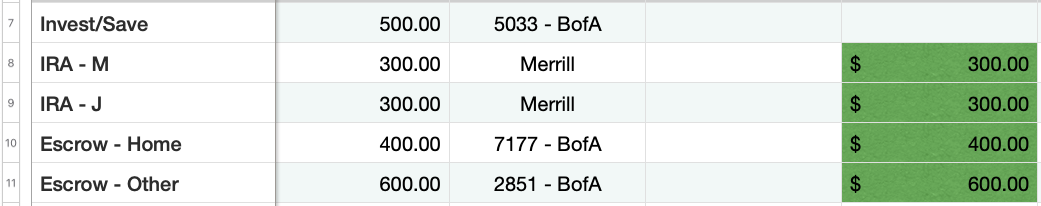

So, I sat down and played the TRANSFER MONEY game, and paid a few bills. $200 automatically to our general savings, $600 to my CMA (in lieu of sending to our two Roth IRAs, since we can't have them right now, income limits), $400 to Escrow for House ins. and property taxes, and then $600 to Escrow Other for all other things that happen once or twice a year.

I don't know what to do with my Student Loan payment - or my $500 extra I have set aside to help pay it down. I have not recieved a bill yet, and I think things are still in limbo at the White House. So, I've decide to put that money into my Snowball account (ear marking all of these deposits, of course), and then make a large payment when we know what's up. It's already Aug, people. I don't need Biden to forgive the whole loan, although I may look into forgiveness... But if he would just stop the interest, we'd all be better off.

My 15 year old, who just started his sophomore year of high school 2 weeks ago, woke me up this morning not feeling well. I had one last at-home Covid test, so we took it... and it was positive immediately. So there's that.

Hoping to get some house DIY done this weekend... we will see!

Posted in

Uncategorized

|

2 Comments »

July 29th, 2022 at 05:29 pm

Oh, we've been gearing up for some baby shower fun, and it's costing us a bit of a pretty penny. All cash, tho (well, card first for points/cash back, but then immediate pay off). I think we are at $2500 right now, and once we have the food purchased, I think our final cost for this big baby shower (plus part wedding reception) will be about $3500.

I was last week years old when I found out that Roth IRAs have an income limit! And here, I just opened up two new ones. So, now I either need to do the back door version, or come up with a new plan I have set aside for the $300 a month each.

Here are our month-end balances for savings...

CU1: $11,327 (+$400)

CU2: $1,029 (+$400)

401K - DH: $34,149 (+$152)

401k1 - H: $42,143 (-$11,391)

401k2 - H: $4,255 (+$487)

Cash: $1,950 (+0)

Roth IRA 1: $300 (+$300)

Roth IRA 2: $300 (+$300)

CMA: $1660 ($500)

This doesn't account for Escrow or our Snowball account.

So, only down $8K, no big deal. 🤪

My prior 401K dropped by $11K due to a loan I had out, and when I left the company, they coded it as a w/d. I am just taking the hit for simplicity's sake.

Waiting for our first mortgage payment to hit (Monday), and I am VERY excited about paying our first extra payment later on in August.

Still waiting to hear about the future of student loans... I am sure we will hear something soon.

Posted in

Uncategorized

|

3 Comments »

July 17th, 2022 at 02:43 am

Not on purpose, but I always forget when the husband gets paid. Meaning, he got paid yesterday, and I didn't do anyting about it. LOL. Until this morning. This paycheck was mostly utilities, but I did have $200 for groceries and $500 to our CMA account - this is where I am going to park the $500 a month, that we plan to use to invest someday.  It's safe there for now. It's safe there for now.

I also added up all of our over-payments, to the tune of $3500, so I went back through ALL of the cards, made any final payments, and I also closed two additional cards. I am only keeping four open, but only have two in my wallet. Costco/Citi for food, gas items (use for points, pay immediately) and then my BofA for monthly household things, which I will pay off each month.

My husband found out last Saturday that he had to go to Oklahoma for 3 weeks for work, he left this past Monday. He does get a PerDiem... I left that in our joint checking for him to use as needed. The overtime he'll collect will be super nice! I have $500 left of the wedding adventures to pay off... for the hotel room I booked for them for the weekend. They had a great time and LOVED the resort. I'll pay that off next week.

I knew July was going to be an interesting month with the expenses, and now with the husband out of town. I am sure we won't see normal until August or September. But I already feel the weight off my shoulders with closing down the cards and seeing all of those zero balances. Well, that and also seeing our savings balances grow already!

Posted in

Uncategorized

|

1 Comments »

July 8th, 2022 at 04:37 pm

When I worked at my previous employer, I was paid on the 15th and last day of the month for 16 years. My new employer pays me every other Friday. Another reason why I really wanted to simplify our situation. I had to move due dates around to make our new structure work, originally. Now it's easy. My husband gets paid on Friday's, the opposite schedule though... so we get paid every Friday. I know you all understand - when you are in a pay down scenario - you can't wait for those paydays to hit!

This was the paycheck that initially funded our new Roth IRAs - so I got to transfer the money this morning!

Also put $400 to our Escrow - Home account (property taxes and homeowners ins), and $600 to our Escrow - Other account (once a year bills, vacation, celebrations, medical). And then I had to pay off the Costco card we used this week (budgeted $400 a month for that, came up $21 over, but had a buffer in my checking I could use to pay in full).Utilities are in this paycheck, $485 went to them. And then some other bills got paid.

I mentioned my daughter is getting married - by the way of the courthouse - today, and then we are taking his immediate family (and their kids/spouses) and ours out to dinner to celebrate. There are 23 of us?! I have $800 cash set aside for tonight's dinner - I think it could be a bit more than that, with the tip. I have extra cash earmarked in future paydays this month to help with any overages there.

Gaah - I am excited for my daughter! Should be a great day, albeit a bit hot... I think we're supposed to hit 109*.

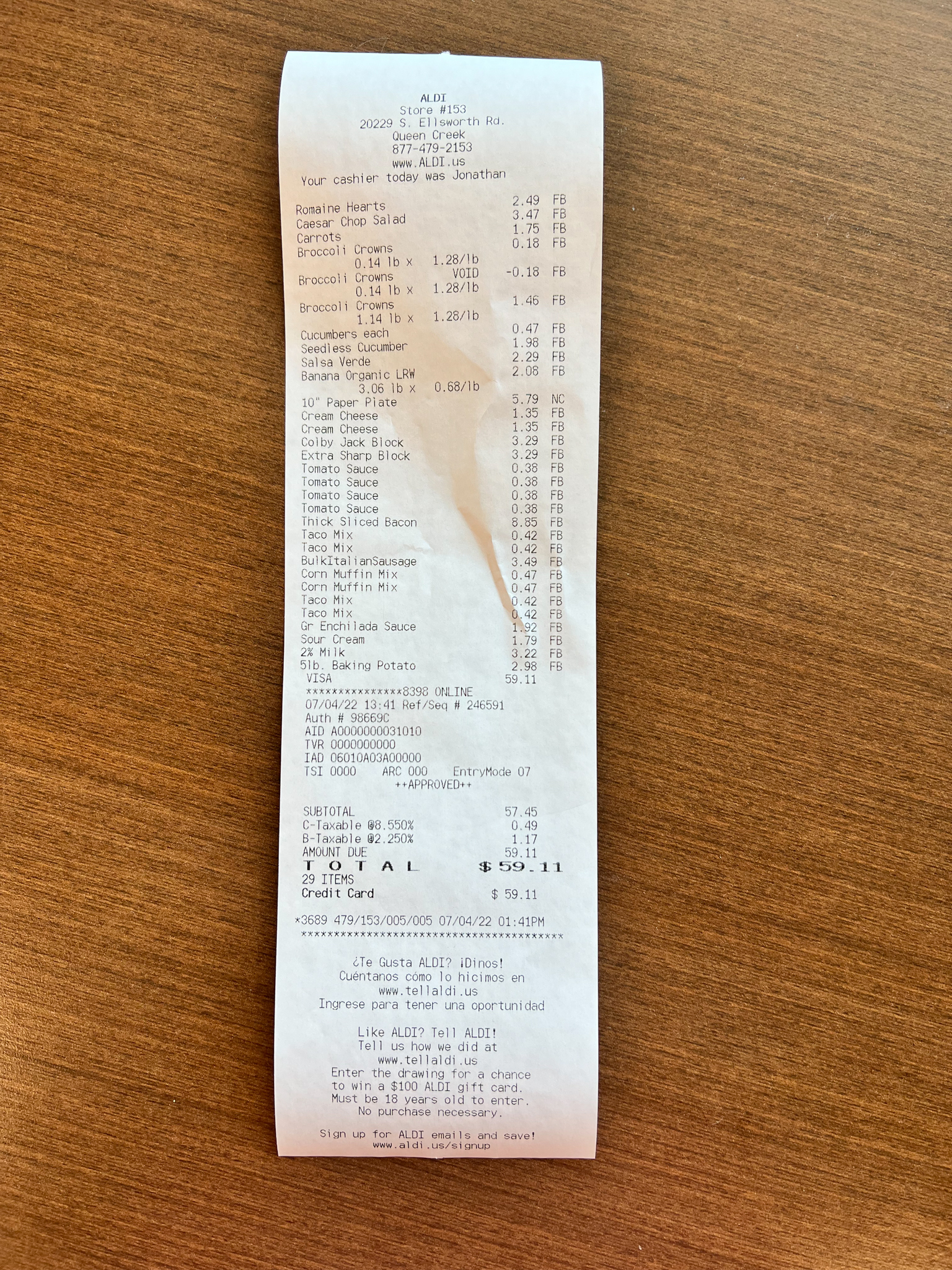

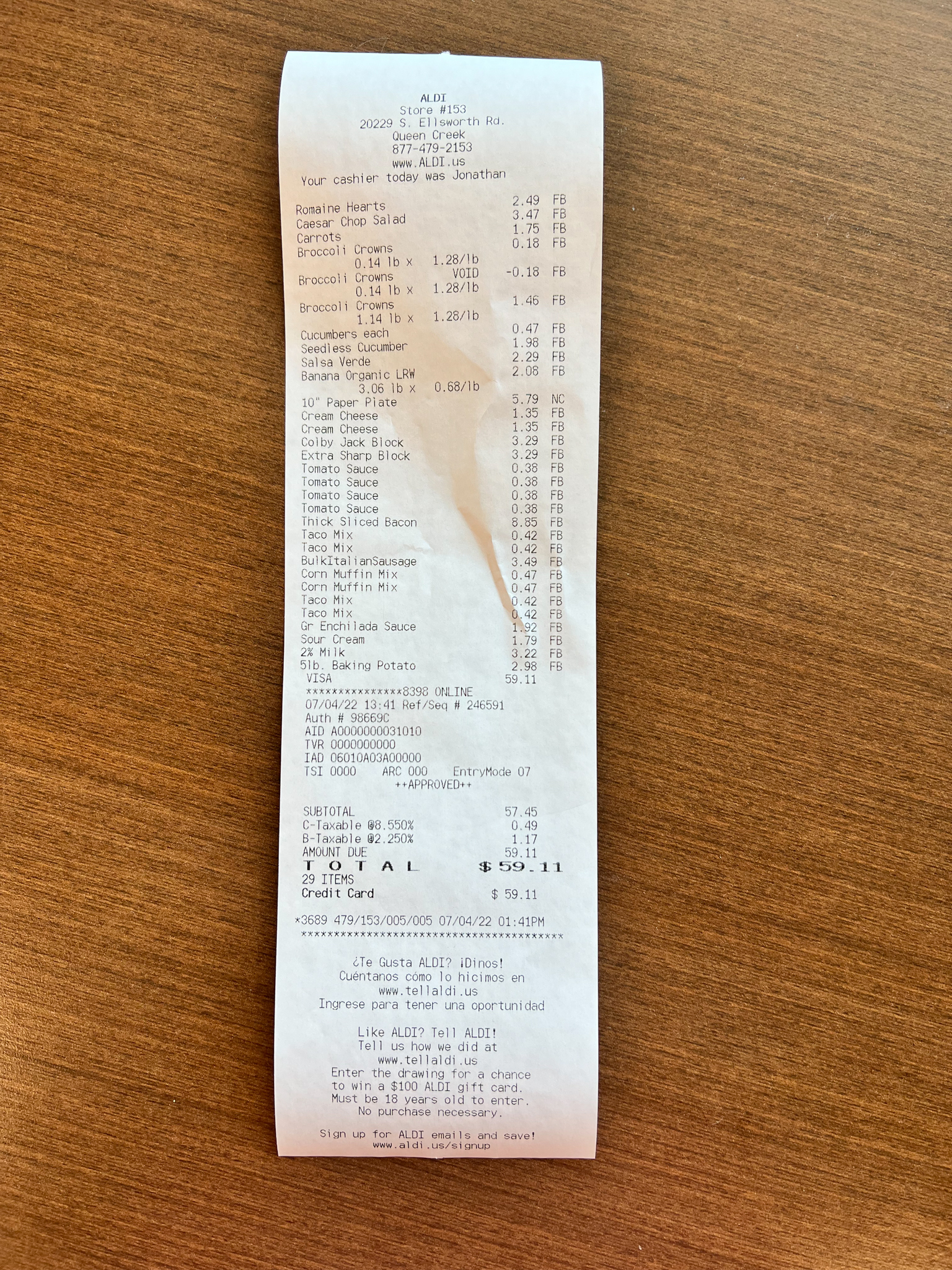

Well, all the bills are now paid. I think I'll sit down in the morning to make our meal plan for next week. We did really good this week. Only spent that $59 at Aldi, and then we spent $35 yesterday for lunch out. Otherwise, good spending week!

Posted in

Budgeting,

Investing,

Saving Money

|

4 Comments »

July 5th, 2022 at 12:22 am

I was planning to hit up both Aldi and Walmart today; however, the oldest kiddo asked if I could watch the baby for about 90 minutes while they hit the gym this morning. I can never say no to that sweet girl. So we hung out, ate pizza, and watched Lilo and Stitch until they came and picked her up.

I then made my way to Aldi, and they had everything I needed. Of course, NONE of it was the brands I am used to, but that's okay. I am treating this like a challenge.

I decided to NOT do drumsticks tonight since I have plenty of frozen chicken breasts, so we are having "fried" chicken, mashed potatoes, corn and corn bread. I only needed to purchase the potatoes and the corn bread mix for tonight. I tried really hard to shop out of my pantry first. At the end of the day, I spent $59.11 at Aldi, and came home with 29 items. Two most expensive things? Paper plates $5.79 (we won't make a trip to Costco until next weekend likely - that's where we usually buy them) and bacon ($8.85 - OUCH. Thick, center cut for the husband - he's lucky he's cute!).

Okay, off to clean the kitchen and then make our 4th of July dinner!

Happy Independence Day, fellow Americans!

Posted in

Uncategorized

|

4 Comments »

July 3rd, 2022 at 11:32 pm

I will admit it here, and maybe only here... I am a brand SNOB. I VERY rarely purchase store brand, off brand or regional branded items. So dumb, and such a waste. Part of this finance overhaul for us is to get our grocery budget under control.

Right now, it's me, my husband and our 15 year old son living at home that we feed. My 23 year old daughter lives in our attached casita - that has a small, functional kitchen (thank gosh for the invention of air fryers and rice cookers!). After this Friday, her new husband will move in with us. While I want them to live as independently as possible, we do love a good family meal. The issue is, we shop as if we are still doing so for 5 people plus kids' friends/girlfriends/boyfriends. So, I need to learn how to scale back for most of the week, and then make a nice family meal on Saturdays to feed up to 7.5 people (counting my 1 year old grand daughter there). The kids don't always take us up on it, but I think once a month is doable.

We just got an Aldi in our community, and our Costco is so close to being finished (right now, we have to drive 15 miles to the closest one - what a chore). We also have Walmart, a Safeway and a Fry's (Kroger). We spend a LOT of money at Costco. We buy all of our meat there. I've been in Aldi's a few times, but I need to see if I can start to really leverage it to lower our food budget. I've also thought about using Walmart pick up for some of the items that are cheaper there. My cinnamon applesauce - MUCH cheaper at Walmart than Fry's or Safeway, for the same exact product and sizing. I love a good challenge, and love coming up with a plan, so I am determined to come up with meal plans, shopping lists and trying out a few new places (all close enough to make sense). Safeway is the closest, but ABSOLUTELY the most expensive.

I've been watching YouTube videos and checking out Pinterest for ideas. Here's one other thing... I've changed up my lifestyle 2 years ago after being diagnosed with Type 2 diabetes. I've lost 60 lbs so far, workout every single day (walks, weights, dancing!) and I try to eat as whole as possible. I can't settle for pasta every night just cuz it's cheap. I can't compromise that... I JUST CAN'T. This means my challenge is even MORE of a challenge!

Here's my meal plan for the week. I will likely go out early tomorrow to grab anything I don't have to make it work.

Week of July 3 - Dinner Plan

Sunday - leftover Green Chili Tacos and (fresh) Spanish rice

Monday - BBQ Drumsticks, Mashed Potatoes Corn on the Cob and Corn Bread

Tuesday - Ground Beef Taco Salad Bowls

Wednesday - Ramen, chicken and veggies

Thursday - Green Chili Chicken Chili

Friday - Dinner out for daughter's wedding (more on that later)

Saturday - Carne Asada and grilled veggies

Posted in

Budgeting,

Food / Groceries,

Saving Money

|

3 Comments »

July 1st, 2022 at 08:51 pm

Well, I am starting our new budget this month! It will still feel a little wonky as I get used to the new situation, and waiting for overpayments and paying off underpayments. Thankfully, there isn't much going to underpayments. I am getting 2K back from our mortgage that was paid off, that I didn't realize. And then there are a few other overpayments here and there.

Today, I "paid" the bills (they are automatic, but I took the time to check the budget, transfer monies, and document everything). The hard part of all of this - is the day to day spending... making sure the husband is using ONLY ONE CARD (vs. a debit card here, our Citi there, etc.). One major reason for the debt consolidation was to KEEP IT SIMPLE. So, we will have a bit of a learning curve... But I know we will be experts soon enough.

This will be a HUGE spending month for us. I am paying for my granddaughter's first 1st birthday party tonight (pizza and wings) and then my daughter is getting married next Friday (simple courthouse wedding with a dinner afterwards for 25 people), so I am paying for that dinner. And then we have her baby shower in August, the room alone cost me $750. All this is much cheaper than a traditional wedding... and I am sincerely happy to do all of this for our kids/grandkids.

I mentioned in one of my last posts that I've opened our new Roth IRAs with Merrill. We are funding them next week! $300 each. Hoping to bump that up to $500 a month for each of us by Feb. of next year (when I am set to get my first raise at my new company). $500 a month will max us out for the year.

July 1 Savings Totals

CU1: $10,926

CU2: $629

401K - DH: $33,017

401k1 - H: $53,534 (previous employer)

401k2 - H: 3,768 (2% contribution)

Cash: $1,950

We have a busy weekend ahead! Hope you all have a fabulous 4th of July!

Posted in

Uncategorized

|

2 Comments »

June 27th, 2022 at 07:38 pm

I can't believe how long it's taking for some of the credit cards to rcv and apply my payments. Frustrating.

I did finally make it to the credit union to pay off a loan. I also took 10K out of our savings account there, and moved it to another credit union we bank (er, save) with. We have been with the original CU for 25 years. And they are making it harder and harder to access my money. Need to call ahead to take out more than $1k. They are closed on Saturdays now. It's 20 miles away, found out the closeure the hard way. LOL. I made 8 cents a month on intrest with a 10K+ balance... and yet, at my new CU, I have a $2600 balance I also made 8 cents on. The math isn't mathing for me anymore, so we are going to close that account. Of course, they allowed me to w/d the 10K (cashiers check), but won't let me close the account. Because joint means nothing.  So, I'll let the husband update his auto-savings and then close that sucker out. So, I'll let the husband update his auto-savings and then close that sucker out.

The theme for 2022 is LESS IS MORE. Less accounts (but more money is good!).

P.S. Spell check or auto correcter is not being my friend today. Sorry for any mistakes.

Posted in

Uncategorized

|

2 Comments »

June 21st, 2022 at 10:16 pm

...

Don't send off checks to pay off your debt (by way of snowballs or refi) on a FRIDAY evening, before a Federal Holiday on the following Monday. You will DIE of anticipation. I swear it. 🤪

I mentioned in my last post that several of the payments stayed local here in the Phoenix area. I've been refreshing my apps all day. AND ONE FINALLY HIT! Yay to Capital One!!! I closed the card over the weekend, I will have to make a $20 payment online, but by the end of that day, that one is a GONER!

Posted in

Uncategorized

|

3 Comments »

June 19th, 2022 at 07:07 pm

My parents treated us to dinner last night, to celebrate Father's Day. We went to Longhorn's Steakhouse, and the food was good and the service excellent. It was nice, it being just the four of us. My parents had us at a young age, mom was 16 with my brother and 19 with me. When you're 45, someone 19 years older isn't that much older. LOL. It's nice having such a great friend.

[[ tried to insert a pic from last night, but SA isn't letting me. i'll try again later.]]

In other news, all creditor checks have been mailed... I only have one left to drop off, to the credit union. Wasn't able to get there yesterday, and it won't be open again until Tuesday. The payment isn't due until July 15, so as long as I can get away soon, there are no problems. The CU is about 20 miles away, so not a fast drive.

I think it's going to take a few weeks for everything to figure itself out. Overages to be reimbursed... shortages to be paid...

I would like to put all of monthly utilities on auto-pay on one of our credit cards, but several of them charge crazy fees to use anything other than EFT. The cash back I am missing out on...

Posted in

Uncategorized

|

3 Comments »

June 18th, 2022 at 03:01 am

You all don't know me. My word means nothing to you. But, I promise, after answering the door today, accepting a UPS envelope full of creditor checks, and then spending HOURS trying to print statements, locate account numbers, GO BUY ENVELOPES, find stamps, etc. etc. etc.... we will NEVER rack up debt again. In all, we recieved 21 checks. I took 4 to Bank of America, and we will take one to the credit union in the morning. The remaining are ready for the Post Office. I am tired and cranky and am so glad I won't have to deal with this again. Everything has been on autopay, without a care in the world, for the past few years. Since we are going to be tightening the purse strings (whether we refi'd or not), I want to keep it SIMPLE.

Now, we wait. Thankfully, several of them are going to Phoenix... so, those should hit the accounts quickly. I love a good zero balance.

Posted in

Uncategorized

|

0 Comments »

June 16th, 2022 at 04:17 pm

Funds from refi were disbursed yesterday, and my old mortgage is now showing paid off. And my new mortgage is saying: PAY ME!

Thanks to some great advice the other day, I have plans to visit some of the locations where I have accounts, and pay directly to them, vs. sending out the check. I don't think I've ever really lost mail - but something about the checks in the mail makes me think they will get lost, and what a hastle that would be.

I need to update my sidebar... and create July's budget! Groceries and Costco are going to be the hard ones to manage... so I need to make a good plan!

Posted in

Uncategorized

|

0 Comments »

June 14th, 2022 at 06:35 pm

Well, it's done! We choose to refi, with debt consolidation. We closed on Friday, and funds will be dispersed tomorrow. The process was super easy, all electronic and virtual... until the disbursement. LOL. They are sending me checks, made out to each debt. That I will then endorse, and SEND VIA SNAIL MAIL to each company. I can't even with that.

Due to timing, we should expect a little bit back from each account, as we have made payments, and not incurred new debt. Anything left over, including a little cash at closing will be snowballed right back into the new mortgage.

I'll be back soon to document the pay off process and our next steps!

Posted in

Uncategorized

|

3 Comments »

May 27th, 2022 at 06:42 pm

I wish SA allowed you to tag someone or reply directly to comments. I wanted to reply to all of you - thank you for your thoughts and feedback. I've loosely followed DR for years, and he's gotten us out of ever having to file bankruptcy and kept us out of the poor house. i 😍 snowballs - but we aren't 20 anymore. Good, bad or indifferent, we are WAY behind on our savings needs (sure, they probably be called goals - but at 45, I'd say they are needs!). If I wanted to go the slow, painful - yet fulfilling - method, I would. I've done it before, I can do it again. But I don't think time is on our side. Our life is so different from even three years ago. I am a grandma now. My parents are trying to buy a home, at their age, in this current market. I could go on and. on and still convince no one that this is what's right for us, right now. And that's okay. It's PERSONAL finance. I am here to be kept honest - and after we make our decision, I'll still need to be kept honest!

If consolidate, our focus will move to paying down our new mortage and my student loans. While I would love to get some reprieve there (at least stop the crazy interest and let me pay the loan off!), I know it's my responsability. I've mocked out a budget through the remainder of the year. One example, we will go from saving $8 - 10K automatically in our Credit Unions to saving/investing a minim of $2500 a month (two personal escrow accounts, each of us will have an IRA and put $300 a month in that, invest $500 a month, and then continue to put that $8-10K away. And this doesn't count 401K contributions.

If we go the Refinance route - we will pay an additional $1500 a month towards principal... and pretend we have a 15 year mortgage. When interest rates come back down, we will refinance to a real 15 year.

All this to say, I've finished looking at our options and wanted to lay them out (more for my sake).

In all scenarios, I can pay more than comfortably pay $4500 a month towards the house.

Refi with existing mortgage company

Details: 5.62% rate, 30 year fixed conventional - payment $3098; will pay $1500 per month to principle

HELOC with CU

Details: variable, current 6%, interest only payments for 10 years (would be about $700 right now, but can seriously balloon); interest and principle for additional 20 years. Felt like if we go this route, I'd make the $700 plus $1300, PLUS $1500 each month and could pay it off way earlier!

HE Loan

Details: 6.99% 12 year fixed, payments will be about $1300

In any of the options, we are touching just a smidge of our equity. In fact, it's about the amount we used as our downpayment three years ago. I say this, because we aren't being greedy and we are not trying to touch the fake equity as I like to call it. We are touching the initial equity we had when we closed on the house.

Which ever option we choose, I am looking forward to getting so serious about savings and paying off the mortgage! AND closing all of those darn cards.

More to come!

Posted in

Uncategorized

|

7 Comments »

May 23rd, 2022 at 02:41 am

We have an opporunity to refinance our house, using our equity to pay off every single cent of debt we owe (except my studen loan). I know it's not the best market to refi right now, since rates have gone up like crazy... but we have about 130K in debt (need to update side bar), and it will take us forever to pay off using the snowball method.

I am very aware that putting all of our eggs in one basket could be scary for us. My mortgage right now is $1785, it would go up to $3100. But my MINIMUM payments alone are more than the difference.

If we do this, we have to 1000000% change our ways. No more debt, no more credit cards. If we do this, we have to pay $1500 a month extra on the mortgage (we plan to stay here for at least the next 10 years), and look to refinance to a 15 year when the market calms down (2 years?!).

All our bills are paid every month... we can afford either scenario. Both have dumb tax tied to them, but one allows us to speed up the process. And honestly, lowering the sheer number of bills we pay each month, will be REALLY nice.

I am looking into one other scenario, a seperate HE Loan. Hopefully will have #s to compare tomorrow.

Posted in

Uncategorized

|

10 Comments »

February 23rd, 2022 at 05:02 pm

In my first post, I shared that I just started with a new company, making 35K more (base salary only) a year. With my sign-on bonus, I am paying off our 2017 Toyota Tundra, which only has 45,000 miles on it, and we owe $10,541. Waiting for that money to be desposited any day now. That monthly payment will free up some cash, to the tune of $625. Just in time for student loan payments to start back up - interest only right now is $620 a month (that's for another post, on another day).

When I took this job, I swore I would use the extra money to pay down debt and to save. Being my usual self, I got scared and only selected 5% contribution to my 401K. Even though the company matches up to 6%. Dumb. I don't know what it is - I just like more cash in my checking account, I guess?

So, yesterday, I got real brave and changed my contribution to 10%. Mind you, I've received two paychecks so far, and neither of them had benefits or pretax items deducted yet. I won't know what my real paycheck is until March 4. I think (don't quote me) that means I'll have $654 a paycheck now going into my retirement account. After taxes, my husband and I both put $200 a paycheck into our credit union savings. I'll have to delve into savings more another time.

Since I did such a good thing, I called my husband up and told him he needs to change his contriibution to 10% asap. He told me it is already at 10%. LOL.

Finally, when I logged into my accounts this morning, I saw that my old bank (job), made a deposit into my 401K. So, I am up about another 6K. Now... I need to make some decisions about what to do with it -- do I roll it into my new 401k? Can you have two 401Ks? Or do I leave it as is? Or do I put it into an IRA. So many questions!

Posted in

Investing,

Personal Finance,

Retirement,

Saving Money

|

5 Comments »

February 22nd, 2022 at 04:10 pm

A long, long time ago, I had an account on SavingAdvice. I could not get the account reset, so I tried to make a new one. I was having a ton of technical issues, and gave up a few times. But, I wanted to be here again so bad... so I sent a few emails, don't think I heard back - but after trying again today, I was able to create a new blog!

This is so what I need to get back into budgeting and saving.

Some background. I worked for a large global bank for 16 years, and just last month decided to be a bit audatious, and applied for a job at another large bank, for 35K more a year (probably could have been more, but I also get nervous and short change myself). I am now making more than I ever thought I would - and at the ripe old age of 46, need to get my life together. OUR LIFE TOGETHER. WE NEED TO GET OUR LIFE TOGETHER. There is a partner in all of this -- my husband of over 27 years.  While he does like to save, I am the bigger nerd who likes to plan to save and pay down debt (which we've done several times over the years -- going for once and for all here, people!) While he does like to save, I am the bigger nerd who likes to plan to save and pay down debt (which we've done several times over the years -- going for once and for all here, people!)

Pardon the dust as I work to get everything all set up. Especially now that my pay frequency/timing has changed and I need to create a budget. We spent the last two years on auto-pilot, spending whatever we wanted. And I am afraid we are going to pay dearly for that come retirement in 20 years (if not sooner).

So, more to come new friends!

Posted in

Budgeting,

Debt,

Personal Finance

|

3 Comments »

|

No idea why. So, I won't be able to pay as much extra to the mortgage now. But I'll figure it all out. Just glad to be refocused! And so thankfully I had that extra savings account I had been socking money into. I would have hated to put cancer treatment on a credit card!

No idea why. So, I won't be able to pay as much extra to the mortgage now. But I'll figure it all out. Just glad to be refocused! And so thankfully I had that extra savings account I had been socking money into. I would have hated to put cancer treatment on a credit card! Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona