That's a wrap on August, and we had the baby shower!

September 2nd, 2022 at 02:04 pmI just typed out a VERY long post, and it’s NO WHERE TO BE FOUND. Oh, Savings Advice… do better.

Let’s try this again.

With August in the rearview mirror, we are feeling a bit beaten up. It was a very spendy month, but we knew that going in.

Baby Shower… when it’s all said and done, and it is - I think we spent about $4500. Thankful my son-in-law’s family contributed $700 and my parents $400. We had a great time, and my daughter and her husband felt LOVED, so that’s all that matters.

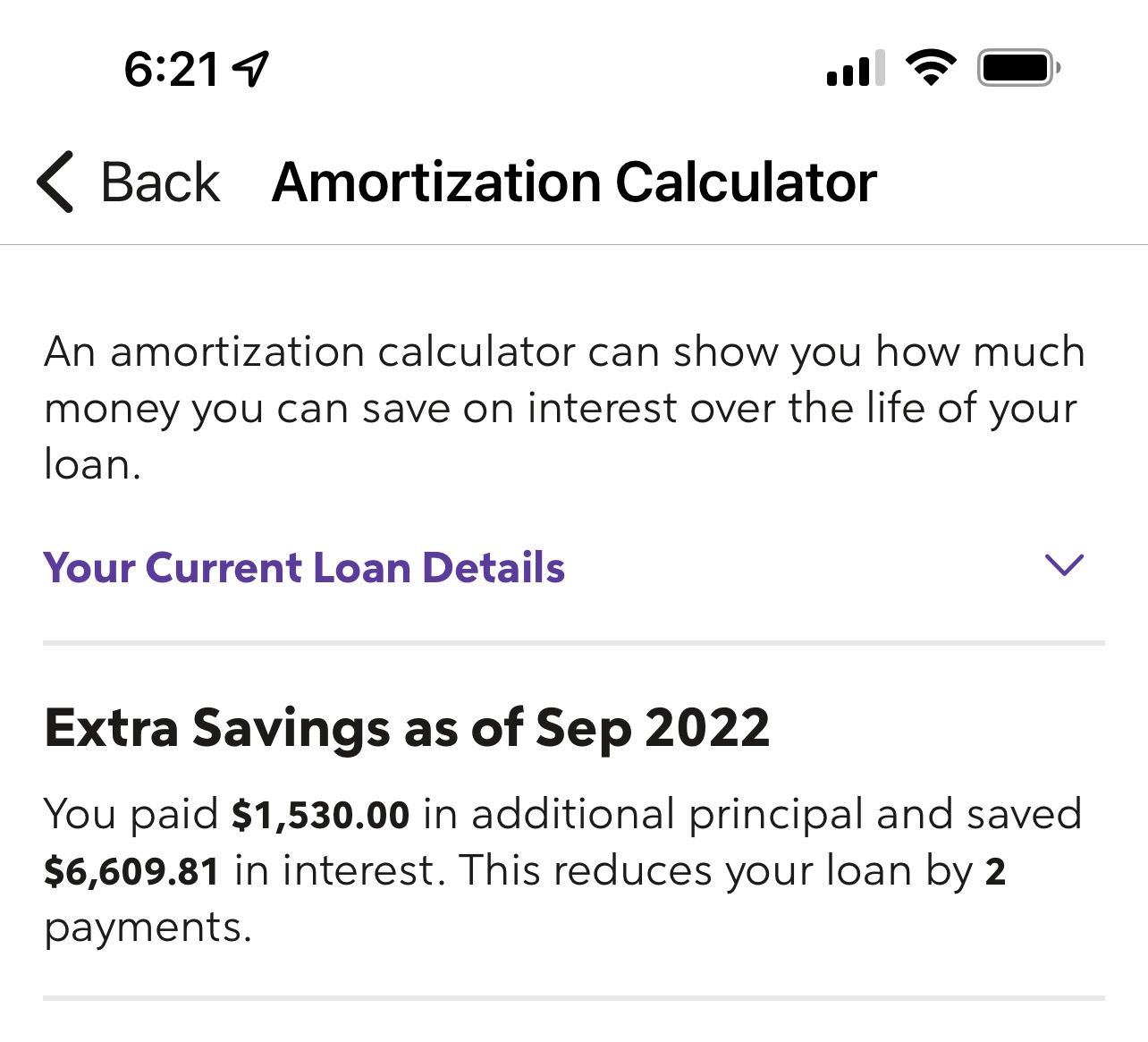

We paid our first mortgage payment ($3098) in July for August, and then I paid an extra $1500 towards principle. That alone saved us two payments and $6600 in interest. Not bad!

As far as a savings update goes, we put $800 in our savings account last month and $1000 in our CMA.

I ended up paying $3125 towards our credit card today… the balance is made up of a $1700 medical bill, the baby shower and then $500 for an old collections account of my daughter’s. During COVID, the power company let them run up their bill without shutting it off for non-payment. She thought it was FREE! Well, last week, I got a letter from the power company saying they added her balance to my PRISTINE account because she was benefiting off of my power. I was LIVID. With her and the company. Called them and spoke to 3 people before I got them to realize they were in the wrong. The rule is, if *I* benefitted from power at both places, then they could transfer the amount owed. Not if *she* benefitted. So, they removed it. I then gave her my credit card and told her to pay the darn balance. I realize no real lesson learned here, other than her having to hear me rant about her irresponsibility. She will pay me back this month. The rest of the card's balance will be paid this month since it's a three-paycheck month for me. So, we should start out Oct. fairly clean.

September is baby month! Because my daughter hasn’t been at her job for a year yet, she won’t get paid 4 months of maternity leave. She can take time off, but it’s all unpaid. She failed to sign up for short term disability (the baby was a happy little surprise!). They crunched the numbers and think she can take off 12 weeks. Of course, she lives with us and her expenses are minimal. So, things will be fine. She did manage to pay off her car, her cards and cash flowed all her pregnancy related medical bills this whole time, so I am thankful for that. Her and her husband are welcome to stay through 2023, but then they are going to look for a place in between both families.

Right around the corner, our property taxes and homeowners insurance is due. We won’t have quite enough saved in our Escrow Home account by then, so I will likely have to borrow from other accounts to cover the gap. But for spring, we should be good!

Okay - see? Long update. Typed out twice. This time in a Word doc, then pasted in to SA. Learned my lesson!

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona