|

|

|

|

Home > Archive: July, 2022

|

|

Archive for July, 2022

July 29th, 2022 at 04:29 pm

Oh, we've been gearing up for some baby shower fun, and it's costing us a bit of a pretty penny. All cash, tho (well, card first for points/cash back, but then immediate pay off). I think we are at $2500 right now, and once we have the food purchased, I think our final cost for this big baby shower (plus part wedding reception) will be about $3500.

I was last week years old when I found out that Roth IRAs have an income limit! And here, I just opened up two new ones. So, now I either need to do the back door version, or come up with a new plan I have set aside for the $300 a month each.

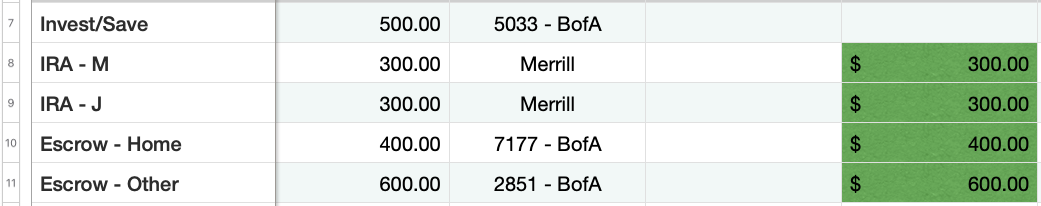

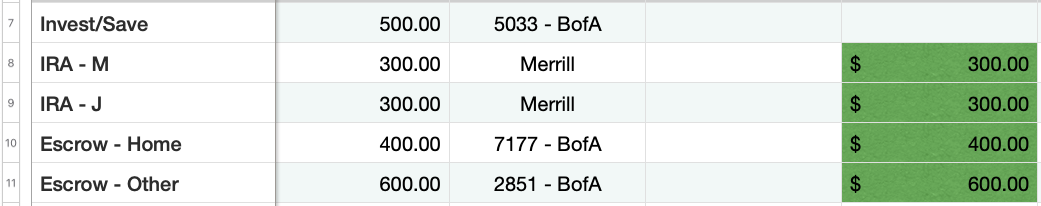

Here are our month-end balances for savings...

CU1: $11,327 (+$400)

CU2: $1,029 (+$400)

401K - DH: $34,149 (+$152)

401k1 - H: $42,143 (-$11,391)

401k2 - H: $4,255 (+$487)

Cash: $1,950 (+0)

Roth IRA 1: $300 (+$300)

Roth IRA 2: $300 (+$300)

CMA: $1660 ($500)

This doesn't account for Escrow or our Snowball account.

So, only down $8K, no big deal. 🤪

My prior 401K dropped by $11K due to a loan I had out, and when I left the company, they coded it as a w/d. I am just taking the hit for simplicity's sake.

Waiting for our first mortgage payment to hit (Monday), and I am VERY excited about paying our first extra payment later on in August.

Still waiting to hear about the future of student loans... I am sure we will hear something soon.

Posted in

Uncategorized

|

3 Comments »

July 17th, 2022 at 01:43 am

Not on purpose, but I always forget when the husband gets paid. Meaning, he got paid yesterday, and I didn't do anyting about it. LOL. Until this morning. This paycheck was mostly utilities, but I did have $200 for groceries and $500 to our CMA account - this is where I am going to park the $500 a month, that we plan to use to invest someday.  It's safe there for now. It's safe there for now.

I also added up all of our over-payments, to the tune of $3500, so I went back through ALL of the cards, made any final payments, and I also closed two additional cards. I am only keeping four open, but only have two in my wallet. Costco/Citi for food, gas items (use for points, pay immediately) and then my BofA for monthly household things, which I will pay off each month.

My husband found out last Saturday that he had to go to Oklahoma for 3 weeks for work, he left this past Monday. He does get a PerDiem... I left that in our joint checking for him to use as needed. The overtime he'll collect will be super nice! I have $500 left of the wedding adventures to pay off... for the hotel room I booked for them for the weekend. They had a great time and LOVED the resort. I'll pay that off next week.

I knew July was going to be an interesting month with the expenses, and now with the husband out of town. I am sure we won't see normal until August or September. But I already feel the weight off my shoulders with closing down the cards and seeing all of those zero balances. Well, that and also seeing our savings balances grow already!

Posted in

Uncategorized

|

1 Comments »

July 8th, 2022 at 03:37 pm

When I worked at my previous employer, I was paid on the 15th and last day of the month for 16 years. My new employer pays me every other Friday. Another reason why I really wanted to simplify our situation. I had to move due dates around to make our new structure work, originally. Now it's easy. My husband gets paid on Friday's, the opposite schedule though... so we get paid every Friday. I know you all understand - when you are in a pay down scenario - you can't wait for those paydays to hit!

This was the paycheck that initially funded our new Roth IRAs - so I got to transfer the money this morning!

Also put $400 to our Escrow - Home account (property taxes and homeowners ins), and $600 to our Escrow - Other account (once a year bills, vacation, celebrations, medical). And then I had to pay off the Costco card we used this week (budgeted $400 a month for that, came up $21 over, but had a buffer in my checking I could use to pay in full).Utilities are in this paycheck, $485 went to them. And then some other bills got paid.

I mentioned my daughter is getting married - by the way of the courthouse - today, and then we are taking his immediate family (and their kids/spouses) and ours out to dinner to celebrate. There are 23 of us?! I have $800 cash set aside for tonight's dinner - I think it could be a bit more than that, with the tip. I have extra cash earmarked in future paydays this month to help with any overages there.

Gaah - I am excited for my daughter! Should be a great day, albeit a bit hot... I think we're supposed to hit 109*.

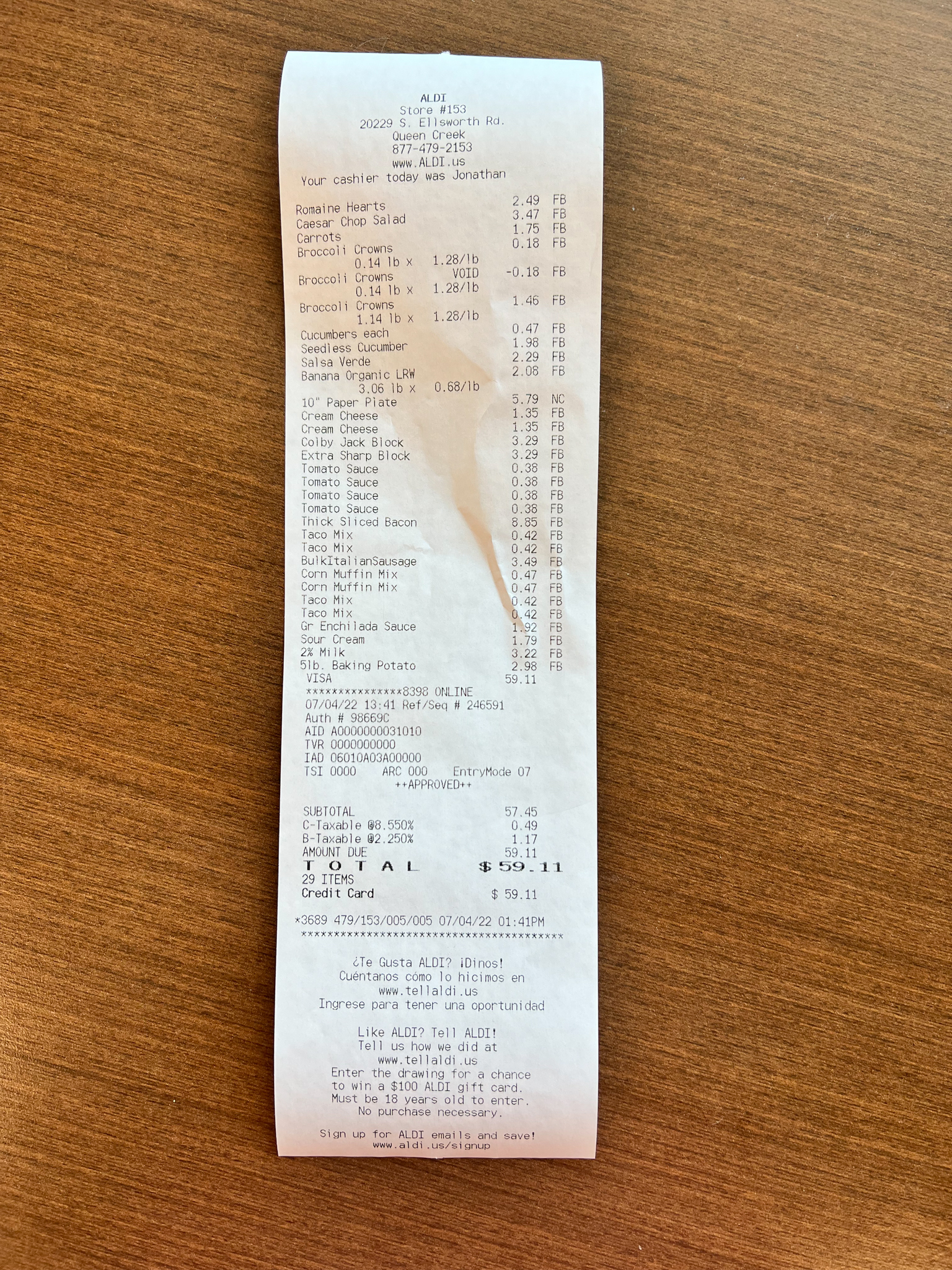

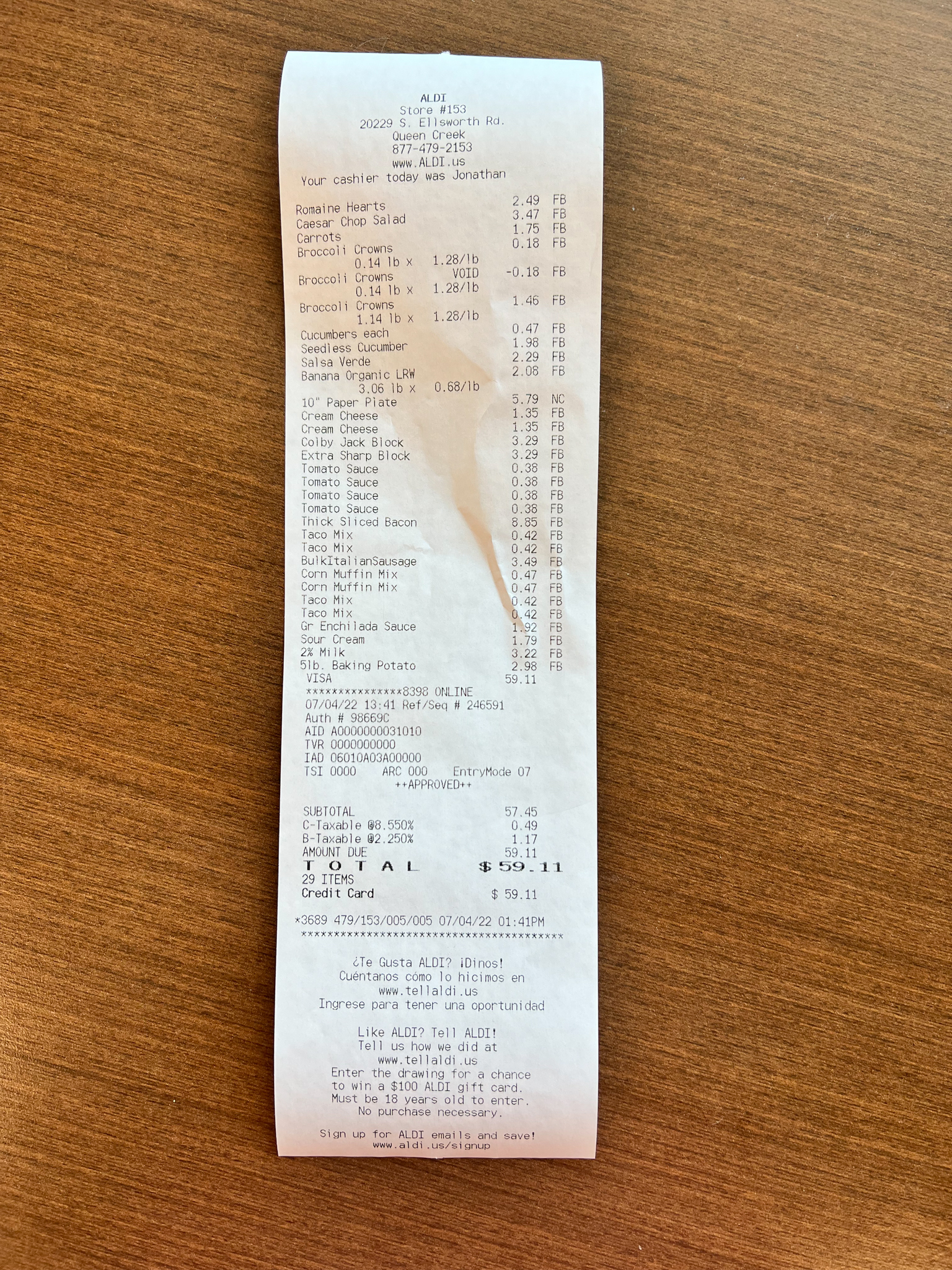

Well, all the bills are now paid. I think I'll sit down in the morning to make our meal plan for next week. We did really good this week. Only spent that $59 at Aldi, and then we spent $35 yesterday for lunch out. Otherwise, good spending week!

Posted in

Budgeting,

Investing,

Saving Money

|

4 Comments »

July 4th, 2022 at 11:22 pm

I was planning to hit up both Aldi and Walmart today; however, the oldest kiddo asked if I could watch the baby for about 90 minutes while they hit the gym this morning. I can never say no to that sweet girl. So we hung out, ate pizza, and watched Lilo and Stitch until they came and picked her up.

I then made my way to Aldi, and they had everything I needed. Of course, NONE of it was the brands I am used to, but that's okay. I am treating this like a challenge.

I decided to NOT do drumsticks tonight since I have plenty of frozen chicken breasts, so we are having "fried" chicken, mashed potatoes, corn and corn bread. I only needed to purchase the potatoes and the corn bread mix for tonight. I tried really hard to shop out of my pantry first. At the end of the day, I spent $59.11 at Aldi, and came home with 29 items. Two most expensive things? Paper plates $5.79 (we won't make a trip to Costco until next weekend likely - that's where we usually buy them) and bacon ($8.85 - OUCH. Thick, center cut for the husband - he's lucky he's cute!).

Okay, off to clean the kitchen and then make our 4th of July dinner!

Happy Independence Day, fellow Americans!

Posted in

Uncategorized

|

4 Comments »

July 3rd, 2022 at 10:32 pm

I will admit it here, and maybe only here... I am a brand SNOB. I VERY rarely purchase store brand, off brand or regional branded items. So dumb, and such a waste. Part of this finance overhaul for us is to get our grocery budget under control.

Right now, it's me, my husband and our 15 year old son living at home that we feed. My 23 year old daughter lives in our attached casita - that has a small, functional kitchen (thank gosh for the invention of air fryers and rice cookers!). After this Friday, her new husband will move in with us. While I want them to live as independently as possible, we do love a good family meal. The issue is, we shop as if we are still doing so for 5 people plus kids' friends/girlfriends/boyfriends. So, I need to learn how to scale back for most of the week, and then make a nice family meal on Saturdays to feed up to 7.5 people (counting my 1 year old grand daughter there). The kids don't always take us up on it, but I think once a month is doable.

We just got an Aldi in our community, and our Costco is so close to being finished (right now, we have to drive 15 miles to the closest one - what a chore). We also have Walmart, a Safeway and a Fry's (Kroger). We spend a LOT of money at Costco. We buy all of our meat there. I've been in Aldi's a few times, but I need to see if I can start to really leverage it to lower our food budget. I've also thought about using Walmart pick up for some of the items that are cheaper there. My cinnamon applesauce - MUCH cheaper at Walmart than Fry's or Safeway, for the same exact product and sizing. I love a good challenge, and love coming up with a plan, so I am determined to come up with meal plans, shopping lists and trying out a few new places (all close enough to make sense). Safeway is the closest, but ABSOLUTELY the most expensive.

I've been watching YouTube videos and checking out Pinterest for ideas. Here's one other thing... I've changed up my lifestyle 2 years ago after being diagnosed with Type 2 diabetes. I've lost 60 lbs so far, workout every single day (walks, weights, dancing!) and I try to eat as whole as possible. I can't settle for pasta every night just cuz it's cheap. I can't compromise that... I JUST CAN'T. This means my challenge is even MORE of a challenge!

Here's my meal plan for the week. I will likely go out early tomorrow to grab anything I don't have to make it work.

Week of July 3 - Dinner Plan

Sunday - leftover Green Chili Tacos and (fresh) Spanish rice

Monday - BBQ Drumsticks, Mashed Potatoes Corn on the Cob and Corn Bread

Tuesday - Ground Beef Taco Salad Bowls

Wednesday - Ramen, chicken and veggies

Thursday - Green Chili Chicken Chili

Friday - Dinner out for daughter's wedding (more on that later)

Saturday - Carne Asada and grilled veggies

Posted in

Budgeting,

Food / Groceries,

Saving Money

|

3 Comments »

July 1st, 2022 at 07:51 pm

Well, I am starting our new budget this month! It will still feel a little wonky as I get used to the new situation, and waiting for overpayments and paying off underpayments. Thankfully, there isn't much going to underpayments. I am getting 2K back from our mortgage that was paid off, that I didn't realize. And then there are a few other overpayments here and there.

Today, I "paid" the bills (they are automatic, but I took the time to check the budget, transfer monies, and document everything). The hard part of all of this - is the day to day spending... making sure the husband is using ONLY ONE CARD (vs. a debit card here, our Citi there, etc.). One major reason for the debt consolidation was to KEEP IT SIMPLE. So, we will have a bit of a learning curve... But I know we will be experts soon enough.

This will be a HUGE spending month for us. I am paying for my granddaughter's first 1st birthday party tonight (pizza and wings) and then my daughter is getting married next Friday (simple courthouse wedding with a dinner afterwards for 25 people), so I am paying for that dinner. And then we have her baby shower in August, the room alone cost me $750. All this is much cheaper than a traditional wedding... and I am sincerely happy to do all of this for our kids/grandkids.

I mentioned in one of my last posts that I've opened our new Roth IRAs with Merrill. We are funding them next week! $300 each. Hoping to bump that up to $500 a month for each of us by Feb. of next year (when I am set to get my first raise at my new company). $500 a month will max us out for the year.

July 1 Savings Totals

CU1: $10,926

CU2: $629

401K - DH: $33,017

401k1 - H: $53,534 (previous employer)

401k2 - H: 3,768 (2% contribution)

Cash: $1,950

We have a busy weekend ahead! Hope you all have a fabulous 4th of July!

Posted in

Uncategorized

|

2 Comments »

|

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona It's safe there for now.

It's safe there for now.