July 8th, 2022 at 03:37 pm

When I worked at my previous employer, I was paid on the 15th and last day of the month for 16 years. My new employer pays me every other Friday. Another reason why I really wanted to simplify our situation. I had to move due dates around to make our new structure work, originally. Now it's easy. My husband gets paid on Friday's, the opposite schedule though... so we get paid every Friday. I know you all understand - when you are in a pay down scenario - you can't wait for those paydays to hit!

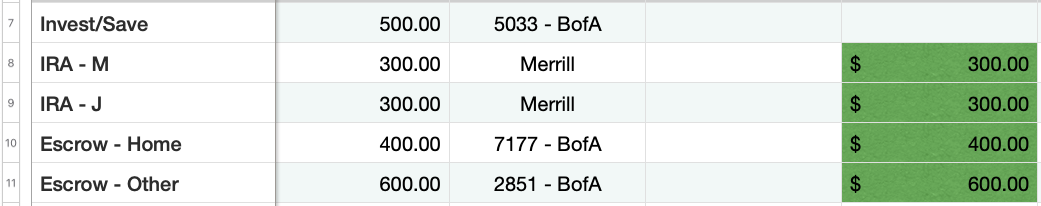

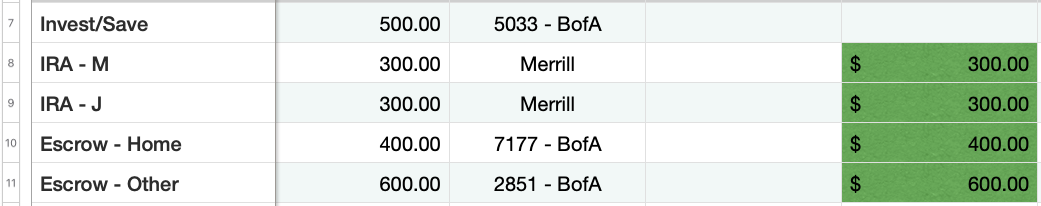

This was the paycheck that initially funded our new Roth IRAs - so I got to transfer the money this morning!

Also put $400 to our Escrow - Home account (property taxes and homeowners ins), and $600 to our Escrow - Other account (once a year bills, vacation, celebrations, medical). And then I had to pay off the Costco card we used this week (budgeted $400 a month for that, came up $21 over, but had a buffer in my checking I could use to pay in full).Utilities are in this paycheck, $485 went to them. And then some other bills got paid.

I mentioned my daughter is getting married - by the way of the courthouse - today, and then we are taking his immediate family (and their kids/spouses) and ours out to dinner to celebrate. There are 23 of us?! I have $800 cash set aside for tonight's dinner - I think it could be a bit more than that, with the tip. I have extra cash earmarked in future paydays this month to help with any overages there.

Gaah - I am excited for my daughter! Should be a great day, albeit a bit hot... I think we're supposed to hit 109*.

Well, all the bills are now paid. I think I'll sit down in the morning to make our meal plan for next week. We did really good this week. Only spent that $59 at Aldi, and then we spent $35 yesterday for lunch out. Otherwise, good spending week!

Posted in

Budgeting,

Investing,

Saving Money

|

4 Comments »

February 23rd, 2022 at 05:02 pm

In my first post, I shared that I just started with a new company, making 35K more (base salary only) a year. With my sign-on bonus, I am paying off our 2017 Toyota Tundra, which only has 45,000 miles on it, and we owe $10,541. Waiting for that money to be desposited any day now. That monthly payment will free up some cash, to the tune of $625. Just in time for student loan payments to start back up - interest only right now is $620 a month (that's for another post, on another day).

When I took this job, I swore I would use the extra money to pay down debt and to save. Being my usual self, I got scared and only selected 5% contribution to my 401K. Even though the company matches up to 6%. Dumb. I don't know what it is - I just like more cash in my checking account, I guess?

So, yesterday, I got real brave and changed my contribution to 10%. Mind you, I've received two paychecks so far, and neither of them had benefits or pretax items deducted yet. I won't know what my real paycheck is until March 4. I think (don't quote me) that means I'll have $654 a paycheck now going into my retirement account. After taxes, my husband and I both put $200 a paycheck into our credit union savings. I'll have to delve into savings more another time.

Since I did such a good thing, I called my husband up and told him he needs to change his contriibution to 10% asap. He told me it is already at 10%. LOL.

Finally, when I logged into my accounts this morning, I saw that my old bank (job), made a deposit into my 401K. So, I am up about another 6K. Now... I need to make some decisions about what to do with it -- do I roll it into my new 401k? Can you have two 401Ks? Or do I leave it as is? Or do I put it into an IRA. So many questions!

Posted in

Investing,

Personal Finance,

Retirement,

Saving Money

|

5 Comments »

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona

Forty-something wife, mom, mother-in-law and grandma (aka Honey) in sunny Arizona